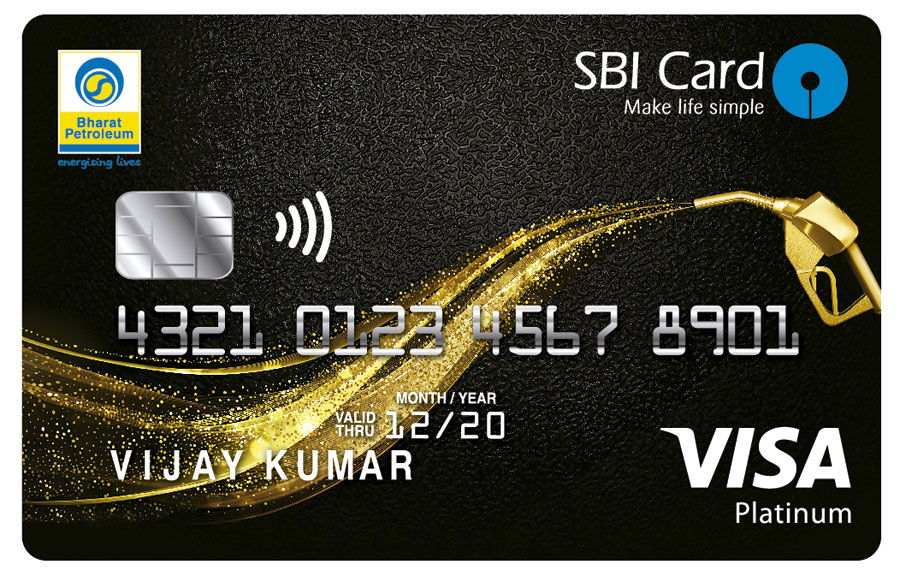

SBICard recently launched a dedicated fuel credit card in association with Bharat Petroleum Corporation Limited and this article is all about SBI BPCL Fuel Credit Card . The features mentioned on the card is kinda bit confusing because of lots of terms and conditions but here we’re to breakdown the numbers.

Overview

| Type | Fuel Credit Card |

| Reward Rate | Upto 3% |

| Annual Fee | 1,000 INR+GST |

| Best for | BPCL Spends |

| USP | Good redemption options |

I would never suggest fuel credit cards to anyone and SBICard support is very poor in that matter. So, stay away!

Joining Fees

| Joining Fee | 500 INR+GST |

| Welcome Benefit | 2000 Points (Rs.500 worth of fuel) |

| Renewal Fee | 500 INR+GST |

| Renewal Fee Waiver | Nil |

Your joining fee is only partly offset by the welcome benefit (except GST). That aside, you don’t get renewal fee waiver with this Card, which is otherwise present in Axis Indian Oil & Citi Indian Oil fuel credit Cards.

Learn More: SBI SimplySAVE Credit Card

Features and benefits

The “13X Reward Points on fuel purchases at BPCL” simply means 13 Points and as the value of each point is Rs. 0.25, effective value out of 13X points = 3.25%. Now lets say you fuel for Rs.1000 and see how much you save.

- Fuel Charge at BPCL: 1000 INR

- -10 INR (1% Surcharge)

- +10 (1% Surcharge Waiver)

- -1.8 (18% GST on surcharge)

- +32.5 (13X Points)

- Total Savings = 30.7 INR Equivalent (3% value)

So, in simple words, you can save max. Rs.325 per month (1300 points max per billing cycle) if you spend ~10,000 INR (may differ if you cross this limit) exactly ON FUEL but the effective savings maybe lot more if you’re currently using a credit/debit card that charges you surcharge.

Apart from the above, you can also get 5X points by spending on certain categories, which will save you 1.25% (5X points) which is OKAY if you don’t have cards like SBI Prime which has wonderful reward rate on many categories.

Conditions:

- SBI Surcharge on Fuel: 1% or Rs.10 whichever is higher (txn value Rs.500-Rs.4000)

- Max Surcharge Waiver: Rs.100/m (Spend: Rs.10,000/m)

- Max txn value per swipe: Rs.4000

Important Note: If you note the first point, the above savings wont work if you fuel BIKES, which is usually in Rs.500 range. Hence, holds good for car fuel spends between Rs.1000 to Rs.4000.

The limits above are in place to avoid charges by commercial vehicle users. Ideally, this is an acceptable limit for the card as its primarily positioned for beginners with BPCL spends.

Bottom line

- Rating: 3.5/5

Its good to see banks come up with dedicated Fuel cards but i wish it could be made even more simple. For example, I always prefer to use Amex cards at HPCL pumps so i get NO surcharge at all – peace of mind.

That aside, overall its a decent card for those who’s getting started with credit cards or for those who like a good value back on fuel charges. If you’re looking for even better fuel card, do check out the list of Best Fuel Credit Cards in India.

What’s your take on the new SBI BPCL partnership? Feel free to share your thoughts in comments below.